What Founders Need to Know to Choose the Right Investors

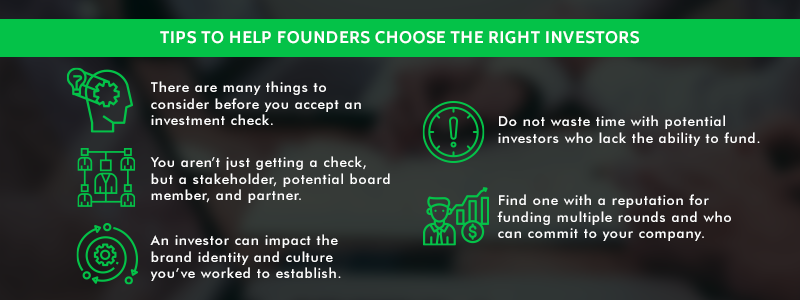

If your business is at the point where it needs investment capital, your ability to choose the right investors can be the difference between flopping and flourishing. Here are some things to consider.

Being able to choose the right investor for your business is a lot like finding the right life partner. There are a lot of things to consider, because you’re getting a stakeholder, a business partner, a potential board member, and someone whose presence may add value to – or subtract it from – your company.

You must do due diligence to ensure you’re selecting the right investors for your company. Here are seven things to consider when faced with this important decision.

Are they right for this stage?

As you start approaching investors, you must consider the round of fundraising your company is in. Venture capital money is nice, but you must be realistic about where you’re currently at in your business. Many people receive angel investor funds and funding from friends and family before they ever receive big league money – and that’s okay.

What’s their ability to fund?

Don’t waste time with someone who doesn’t have the funds. Doing your research is fundamental. Learn the last time they funded a project, what else they’ve funded, and how the investments are performing. An investor whose investments are doing poorly is likely to apply a considerable amount of unnecessary pressure if they see your business as a means to recoup their funds. That’s probably not something you want to deal with – especially if you can get funded elsewhere. Additionally, you’ll want an investor who can provide further rounds of funding.

Are they known for investing in multiple rounds?

Hiring new employees is stressful, time-consuming, and expensive, as is having to find new investors at each round. Remember you’re looking for partners, not just money. Having to bring on new partners at every round will also majorly diminish your stake in your own company. Remedy this by choosing investors who are already known to fund multiple rounds.

Are they a good fit for your brand and company culture?

It’s likely that investors will be on your board, meaning they can have major influence over the brand and company culture you’ve worked so hard to create. They can either contribute to or totally derail your vision. Consider compatibility when it comes to this relationship in the same way you’d approach compatibility for marriage. It’s vital to choose the right investors: those who are compatible and aligned with your brand and company culture.

How committed are they to you?

As part of due diligence, you’ll want to find out how much time and energy they’ll be able to devote to you and your company. This person or entity will likely be joining your board. It’s more than appropriate to ask them about other boards they’re serving on, what kind of communication they expect, and how often you’ll be interacting. Will they be able to give you more access to them if you need or want it?

Can you work well with them?

This is perhaps one of the most overlooked – yet most important – aspects when you choose the right investors. Remember that you aren’t just getting money out of the deal. You’re choosing business partners and, hopefully, long-term relationships because they’d ideally be funding multiple rounds. Is this someone you and your team can work well with? Loosing your team because of a difficult investor will definitely be a major setback, plus make retention difficult for future hires as you rebuild.

Can they add value beyond money?

How can they add value? When you bring an investor on, you aren’t just getting money. You’re also getting their business expertise, access to their network (including other contacts with capital), and their industry influence. They may even make your company look more appealing to other investors because they are known for savvy and successful investments. This works both ways, though, and having the wrong investors on board may deter others from doing business with you. At any rate, sometimes the non-financial gains can be the most valuable aspect of the partnership.

Get help from the experts with scaling your business

If you want to be able to choose the right investors and get them interested in your business, you need to be scaling. It’s difficult to do alone, but having a rockstar sales team can help.

At MetaGrowth Ventures, we specialize in building high-performing sales teams. We support founders in building out their teams by making sure they hire the right personnel the first time around. Our rigorous five-step hiring process allows us to get you the right candidates for the job. We also know that top sales teams need top-quality training, so we prioritize it. If you haven’t yet memorialized and automated your company’s training, we’ll help create a digital library of on-demand training content for your team.

If you’re ready to ditch the daily grind of founder selling, contact us today.

Written by

Josh Hirsch